The allowable deduction for interest expense shall be reduced by an amount equal to 20 of interest income that is subject to final tax if any. F20 Domestic tourism expenses 24 - Tax schedule for year of assessment 2021 26 EXPLANATORY NOTES be 2021 RESIDENT.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

. Active members attend club meetings have voting privileges may be elected as an officer of the club shall be counted towards a quorum of the club membership may participate in speech contests if they fulfill the other eligibility criteria and. Expenses related to gifts with a value of EUR 50 or less are entirely deductible. Knowing what expenses are not tax deductible might help company to minimise such expenses.

Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Tax saving Fixed deposit is similar to the regular fixed deposit offered by banks. Bundle your internet plan with TV entertainment for the family.

However an SME defined as a company with paid-in capital of JPY 100 million or less except for a company wholly. Entertainment expenses related to local leave passage to employee to facilitate yearly company event. Properly Documenting All Income and Deductible Expenses.

Other eligible capital expenditures include plant and machinery motor vehicles and research and development of computer software packages. Then Regulation Section 1162-3d allows the expense and resulting tax deduction to be taken ratably over the period your company enjoys the benefit of the insurance coverage. Deduction of entertainment expenditure is restricted to the amount of entertainment.

Start-up expenses are deductible when incurred. Purchase down payment optional - If you plan to make a down payment enter it here. You must include them in your rental income.

When it comes to finding out the difference we can say that it offers a lock-in period of 5 years. If the amount of remuneration is deemed unreasonable by the tax authority only the reasonable amount is deductible for tax purposes. Copy and paste this code into your website.

Employee salary and bonuses -- as well as the payroll taxes on the amounts paid -- are deductible by the corporation and with a 35 corporate tax rate each dollar paid as compensation saves the. The interest earned from any tax saving FD depends on. Single deduction for pre-commencement expenses-Withholding tax exemption on any payments made to non-residents wef 10102011 to 31122021.

If you want your down payment to be a specific percentage of the purchase amount you can use the. The calculation of tax on the taxable profits of branch offices of non-resident companies is the same as for other businesses. Amount N4 from Working Sheet HK-2.

The monthly maximum limit is 20 AFN 8900 fixed amount. Expenses that were not incurred in the production of profits. With effect from the Year of.

Learn the Basics. On June 2 the President approved amendments to the Tax Code providing tax benefits to businesses affected by the COVID pandemicAzN 012 bn or 02 percent of GDP. Such as emergency medical expenses cancelled or delayed flights lost or stolen luggage and personal liabilities should you cause damage to a.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Entertainment expenses that do not meet these requirements cannot be deducted. This lets us find the.

You have to have a high-deductible medical plan and the contribution limit is 3350 for an individual or 6750 for a family. Expenses paid by tenant occur if your tenant pays any of your expenses. 30 of value added exports.

Glossary of Governing Documents. Ie 112 in. Deductible up to 70 of SI.

Higher tax rates than the regular corporate rate may also be applied in other special cases. Meals and lodging expenses. However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible.

Will sales tax be financed optional - If you want the sales tax amount added to the loan amount answer Yes. Tax Saving Fixed Deposit. Of both types of expenditure are neither deductible nor liable to tax.

Companies can claim capital allowances on most asset purchases that are for use in business. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs. This lets us find the.

For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. Norway imposes an active shareholder tax if resident shareholders own two-thirds of the shares and actively participate in the companys business. Expenses that are not incurred.

Entertainment expenses directly related to sales provided to customers dealers or distributors not suppliers. In principle entertainment expenses are not deductible for tax purposes. You can deduct the expenses if they are deductible rental expenses.

Sales tax on purchase - Enter the tax rate used for calculating sales tax. The percentage of reduction was adjusted from 33 as a result of the lower CIT of 25 under the CREATE Law. Income Tax 101 with our easy to use calculator and tax guides.

Theres been a lot of talk in Congress about slashing the lifetime exemption for estate and gift taxes currently 117 million per. In general expenses incurred for the production of business income are tax deductible. Individuals are subject to tax at progressive rates.

For IRES purposes the deduction for meals and lodging expenses incurred within the municipality is limited to 75 of the amount incurred. The tax is calculated at 20 of income after allowing certain deductible expenses. Active Member An individual who is a paid member in good standing with Toastmasters International.

Every business needs to employ a record-keeping system that accurately and completely captures all income and deductible expenses. The company may reimburse the tax as a non-deductible expense. Capital allowances in Malaysia are therefore deductible expenses.

Section 80C of the Income Tax Act states that the PPF account renders tax deduction. The amendments grant a one-year exemption from land and property tax to selected sectors including tourism passenger road transportation and cultural facilities. The following are more common non-allowable expenses.

Savers age 55 and older can add an additional 1000 to their.

A Critique Of Recent Tax Cases Ai Chartered Tax Institute Of Malaysia

Tax Treatment For Entertainment Expenses

A Critique Of Recent Tax Cases Ai Chartered Tax Institute Of Malaysia

What Is A Decent Salary To Live On In Malaysia Quora

Adjust Your Tax Strategies For The New Normal Grant Thornton

Pemerkasa Assistance Package Crowe Malaysia Plt

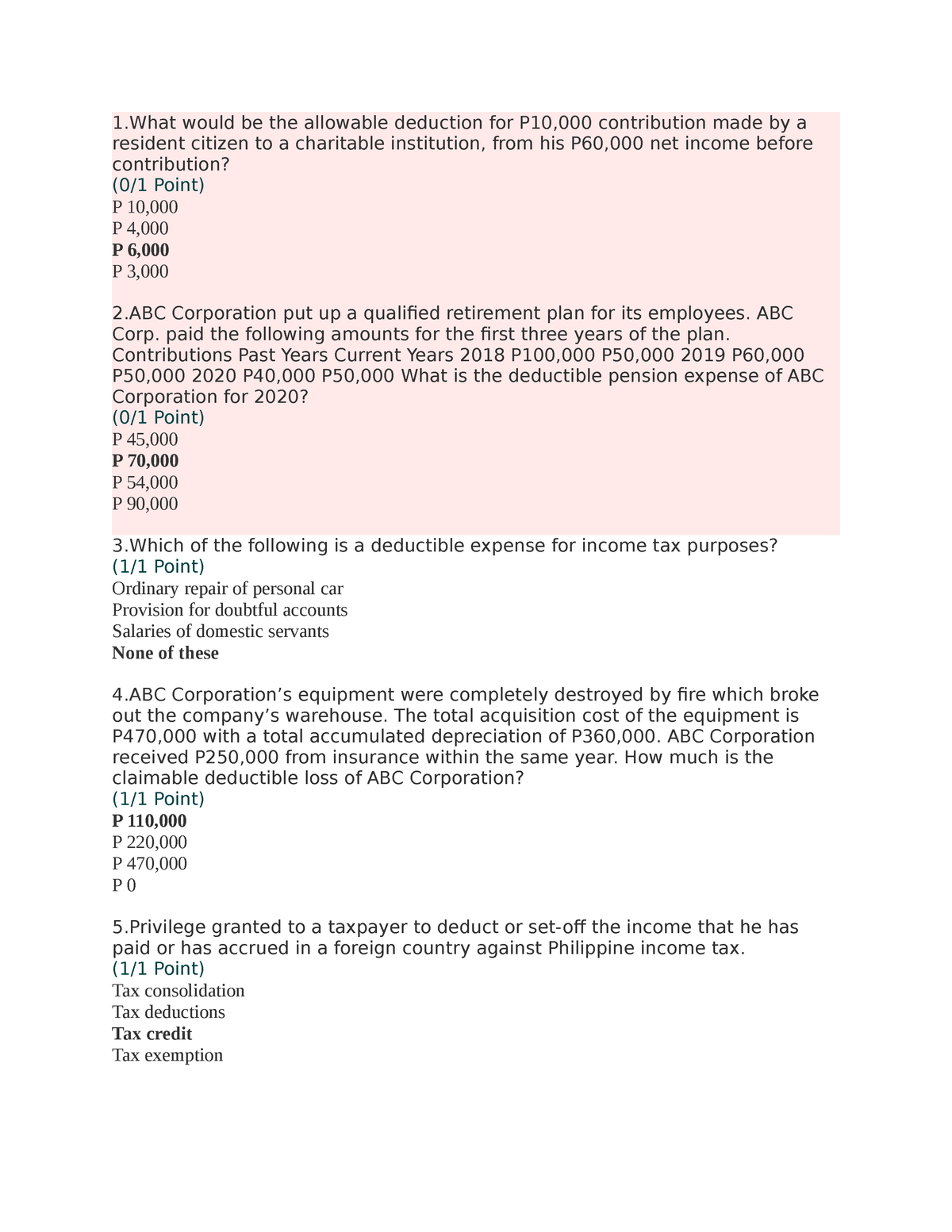

Final Exam Taxation Reviewer 1 Would Be The Allowable Deduction For P10 000 Contribution Made By Studocu

Malaysian Institute Of Accountants Sabah Regional Office Photos Facebook

Types Of Taxes In Malaysia For Companies

Getting Ready For The P11d Deadline This July